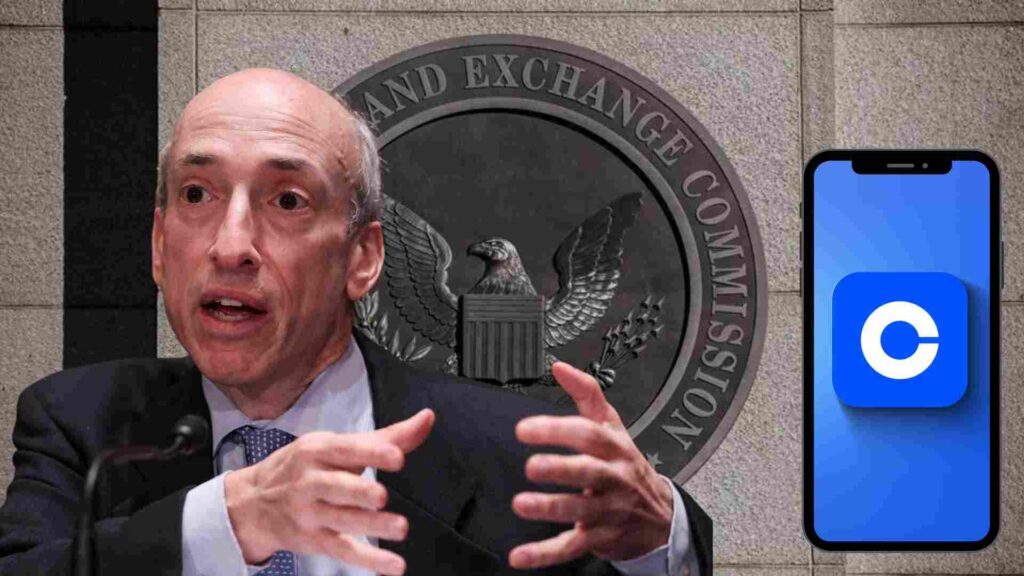

Coinbase, a prominent cryptocurrency exchange, has seen some quick advancements in the ongoing Coinbase Vs SEC lawsuit. The company has decided to narrow the scope of its subpoena targeting SEC Chair Gensler. This revision follows concerns raised by U.S. District Judge Katherine Polk Failla regarding the initial subpoena’s extensive demands.

Initial Subpoena and Judge’s Concerns

Coinbase’s subpoena was sought in June and communications regarding Chair Gensler’s previous statements on cryptocurrencies, date back to 2017 before he assumed his role as SEC Chair in 2021. Judge Failla raised doubts during a pre-trial motion conference on July 11th, particularly questioning the relevance of Gensler’s private conversations about cryptocurrencies.

Revised Approach and Legal Strategy

As a response to Judge Failla, Coinbase’s legal team opted to refine their request, focusing exclusively on documents relevant to Chair Gensler term. This adjustment was disclosed in a recent court filing, with Coinbase intending to file a motion compelling the SEC to provide the requested documents by July 23rd.

New minute entry in SEC v. Coinbase: Minute Entry for proceedings held before Judge Katherine Polk Failla: Pre-Motion Conference held on 7/11/2024. Attorneys Jorge Gerardo Tenreiro, Nicholas Margida, Patrick…

— Big Cases Bot (@big_cases) July 15, 2024

[full entry below 👇]

Docket: https://t.co/xzF4ofOHTw#CL67478179 pic.twitter.com/YO1WTtAhzO

SEC’s Regulatory Landscape and Recent Developments

The Coinbase Vs SEC dispute is part of broader regulatory efforts within the cryptocurrency market. The SEC has accused Coinbase of operating as an unregistered dealer and clearing agency. While Coinbase’s motion to dismiss the lawsuit was partially denied in March, the case continues to evolve under new SEC lawyer Elizabeth Goody.

Speculation and Industry Dialogue

Amidst regulatory tensions, Coinbase’s Chief Legal Officer, Paul Grewal, has hinted at a potential shift in the SEC’s stance towards the crypto industry. Grewal suggests that recent actions by the SEC may indicate a willingness to engage in constructive dialogue rather than solely relying on enforcement measures. This approach could signify a new phase of interaction between regulators and the cryptocurrency sector.

The outcome of this case may influence future regulatory approaches and industry dynamics, shaping the landscape for cryptocurrencies and blockchain technology.

Other Relevant Updates

- The U.S. SEC Rejects Coinbase’s Petition For Crypto Regulations

- Coinbase vs SEC – Agency Defends Its Move Regarding Crypto Asset Rulemaking

Stay tuned at ReadingCrypto and never miss out on any future updates!

Disclaimer: This post is intended solely for informational purposes and should not be taken as legal, tax, investment, financial, or any other form of advice. Although all the information provided is true to the best of our knowledge, it is advisable to research well before making any kind of investments or decisions in general. The team of ReadingCrypto bears no responsibility in the event of any adverse outcomes.