When trading cryptocurrencies, it’s essential to grasp the differences between maker vs taker fees. These fees depend on the type of order you use and can affect your trading costs significantly. This guide explains maker vs taker fees, highlights the Binance fees, Coinbase fees, and Kraken fees, and helps you find the lowest maker and taker fees across different exchanges.

What Are Maker Fees?

Maker fees are charged when you place a limit order. A limit order allows you to set a specific price at which you want to buy or sell a cryptocurrency. By doing this, you are providing liquidity to the exchange’s order book, making you a “maker” of liquidity.

Example of Maker Fees

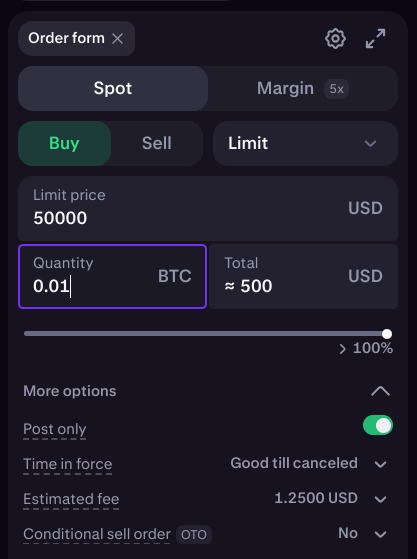

Let’s use Kraken Pro’s fee structure to illustrate maker fees:

- Fee Structure: Kraken fees have different fees based on how much you trade over 30 days. For example, if you trade up to $10,000 the maker fee is 0.25%.

Suppose, you place a limit order to sell 0.01 BTC at $50,000, your maker fee would be:

- Trade Value: $50,000 x 0.01 = $500

- Fee Calculation: $500 x 0.25% = $1.25 (or $500 x 0.20% = $1.00, depending on your trading volume tier)

What Are Taker Fees?

Taker fees apply to market orders. A market order buys or sells a cryptocurrency immediately at the best available price. This type of order removes liquidity from the exchange’s order book, which means you are a “taker” of liquidity.

Example of Taker Fees

Here’s what Kraken fees look like concerning the taker fee structure:

- Fee Structure: Kraken charges a 0.40% taker fee at the base level.

If you buy 0.01 BTC using a market order and the order is filled as follows:

- Order Execution:

- 0.0025 BTC at $50,000

- 0.0075 BTC at $50,500

- Total Cost: $125 + $378.75 = $503.75

- Fee Calculation:

- $125 x 0.40% = $0.50

- $378.75 x 0.40% = $1.515

- Total Taker Fee: $0.50 + $1.515 = $2.015

This means using a market order costs $3.75 more than using a limit order due to the higher taker fees.

Let’s read more about it!

Binance Fees Structure

Binance, the largest crypto exchange by trading volume, charges a standard fee of 0.1% for both maker and taker trades, allowing for quick trades without high costs. You can get a 25% discount on fees by using BNB, lowering the fee to 0.075%. Binance also has nine VIP levels that offer additional fee discounts based on how much you trade and how much BNB you hold.

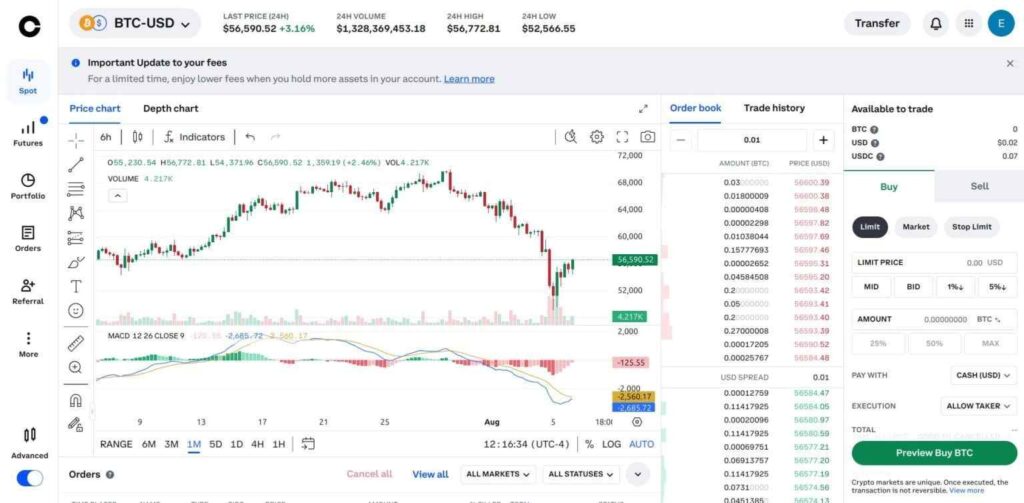

Coinbase Fees Structure

Coinbase, a major exchange, charges higher fees compared to Binance. The base fee is 0.6% for maker orders and 1.2% for taker orders. If you trade $1,000 or more in 30 days, fees drop to 0.35% for maker orders and 0.75% for taker orders. Coinbase also offers a subscription called Coinbase One that provides fee-free trading for active users.

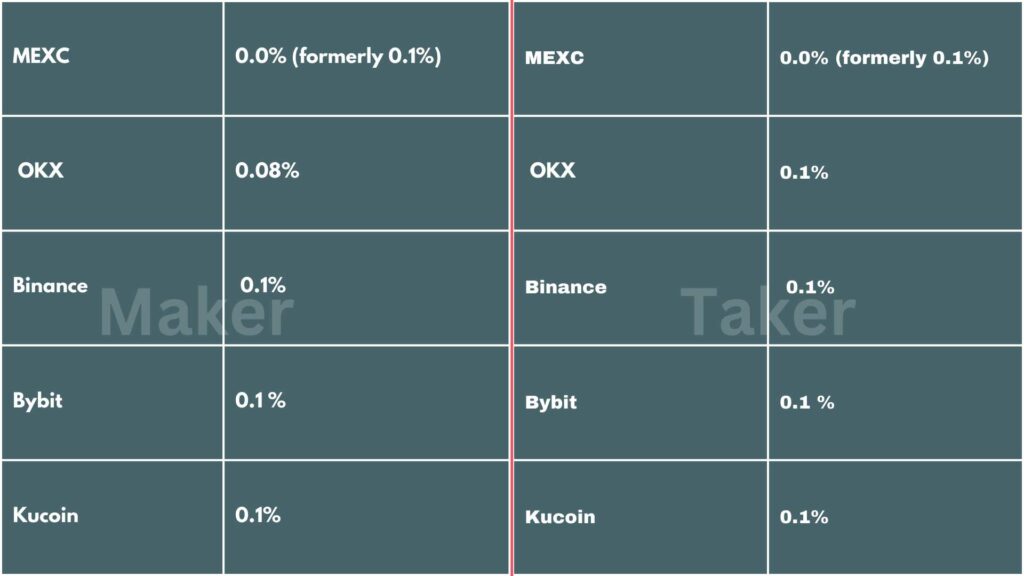

Which Exchange Has The Lowest Maker Taker Fee?

Here are some of the exchanges that provide you with the most affordable and cheap maker-taker fee options –

Maker Fee

| MEXC | 0.0% (formerly 0.1%) |

| OKX | 0.08% |

| Binance | 0.1% |

| Bybit | 0.1 % |

| Kucoin | 0.1% |

Taker Fee

| MEXC | 0.0% (formerly 0.1%) |

| OKX | 0.1% |

| Binance | 0.1% |

| Bybit | 0.1 % |

| Kucoin | 0.1% |

Conclusion

Understanding maker vs taker fees is crucial for cryptocurrency trading. Maker fees apply to limit orders and add liquidity, while taker fees apply to market orders and remove liquidity. Binance offers low fees with potential discounts, Coinbase has higher fees but offers tiered reductions, and MEXC, OKX, Binance, Bybit, and Kucoin provide competitive rates.

To read more articles like this, head on to ReadingCrypto!

Disclaimer: This post is intended solely for informational purposes and should not be taken as legal, tax, investment, financial, or any other form of advice. Although all the information provided is true to the best of our knowledge, it is advisable to research well before making any kind of investments or decisions in general. The team of ReadingCrypto bears no responsibility in the event of any adverse outcomes.