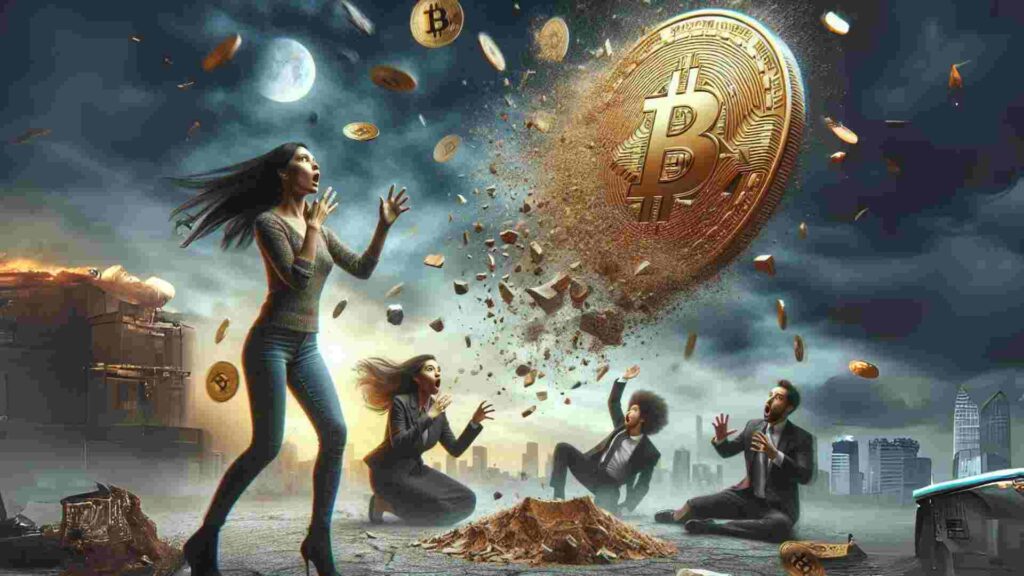

As of August 5 2024, Bitcoin prices are on a steep decline, falling under $50000 for the first time since February. Bitcoin touched as low as $49111.1 before recovering to nearly $50193. That’s just a week after its trade approached $70000.

Why Is Bitcoin Crashing?

Summarizing Bitcoin’s price decline that is connected to the general market crash, July’s worse-than-anticipated employment paper spilt anxiety for an eventual economic downfall. As a result, global equity markets like Nasdaq have been subjected to a selloff in which Bitcoin has followed suit.

Impact on Cryptocurrencies

The Bitcoin crash 2024 is an indication of what can be dubbed as a long-standing trend that has been affecting the cryptocurrency trends. Additionally, Ether also lost 9% to settle at $2,481.85.

Further on, stocks of companies such as Coinbase and MicroStrategy were also adversely affected in this particular instance with the former dropping by 19% while the latter sank by 26%. Previously however there were fluctuations in global markets including corrections on the Nasdaq and bear markets in Japan among others.

Also Read: Bitcoin Falls As The US Government Moves Seized Crypto Worth $2 Billion

What’s Next for Bitcoin?

Saturday marked a decline of more than 15% in Bitcoin’s price; thus, this cryptocurrency experienced its worst month ever in August dropping almost 23%. Even though it has gone up by about eighteen per cent during this year up until now, some would say that there are uncertainties regarding maintaining high amounts of savings with such fluctuating values around it.

These fluctuations according to market responses indicate potentially profitable opportunities associated with (long-term) ownership of such currencies as bitcoin but the danger for immediate action since prices fluctuate widely within a week time frame.

For more such informative reads, stay tuned at ReadingCrypto!