The cryptocurrency market is facing severe losses, witnessing the worst crypto market crash since 2022. Numerous altcoins have plummeted by 20% to 50% in just a single day, reflecting the harsh nature of this crypto market crash.

However, this crypto market crash today is not just confined to crypto alone; the global markets are also experiencing turmoil. The sharp decline in crypto prices can be linked to the volatility of the crypto markets, and most importantly, crypto as a high-risk asset.

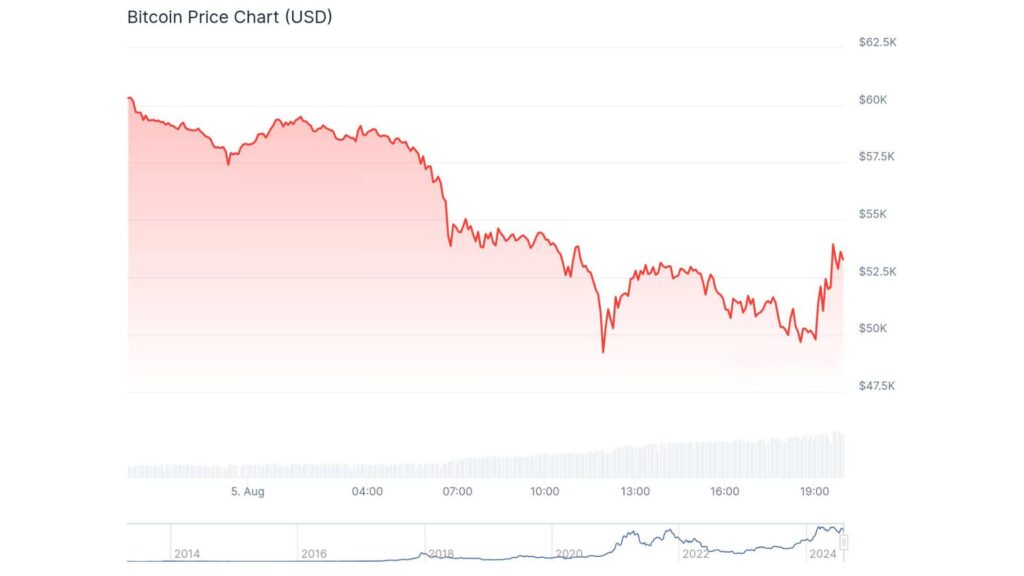

Bitcoin, the king of the crypto market, has been at the forefront of this crypto market crash. The cryptocurrency fell sharply below the crucial $60,000 mark, triggering a wave of liquidations that drove its price down to as low as $50,000. Currently, Bitcoin seems to have stabilized temporarily around $52,871.61, reflecting a decrease of 11.7%.

The recent sell-off was significant, with more than $1 billion in liquidations in the last day alone. This is one of the largest such events since the FTX collapse. Although market leverage has decreased, the overall impact on market value has been substantial, wiping out billions of dollars.

Why Is The Crypto Market Crashing?

Here’s why the worst crash since the crypto market crash 2022 has happened –

Factors Contributing to the Downturn:

- Recent political developments and shifts in market sentiment have played a significant role in shaping this very crypto market crash.

- Initial optimism surrounding a “Sovereign Bitcoin” narrative, motioned by Trump’s recent rally.

- Market sentiment turned cautious amid indications favoring Kamala Harris over Trump in upcoming events.

Critical Analysis

- Despite the severity of the downturn and widespread liquidations, analysts like Miles Deutscher view these corrections as potential opportunities.

- They emphasize that such market adjustments often pave the way for new investment prospects.

- Analysts highlight upcoming catalysts that could positively impact market dynamics shortly

Conclusion

In conclusion, while the current crypto crash is one of the worst since 2022, analysts think there’s a chance the market could bounce back and offer new opportunities despite the current instability.

Stay tuned at ReadingCrypto for more of such updates!