Monolith Management, an investment company founded by Cao Xi, a former partner of Sequoia China, disclosed that it owns more than $24 million of BlackRock’s spot bitcoin ETF. The Hong Kong-based company has more than twice as much invested in BlackRock Bitcoin ETF as it does in Meta shares, making it its seventh largest holding.

Have a look at the whole news below-

- According to a report on Tuesday on Bitcoin ETF News, the investment firm of a former Sequoia China executive disclosed that it owned more than $24 million of BlackRock Bitcoin ETF.

- Monolith Management disclosed that it has more than $24 million in BlackRock Bitcoin ETF, trading symbol IBIT, in a filing with the Securities and Exchange Commission.

- According to the report, it represents the Hong Kong-based company’s fifth-largest position and is more than twice as large as its stake in Mark Zuckerberg’s Meta. Also, as per the report, the top two investments of the firm were – Nvidia and Microsoft.

IvyRock Asset Management

According to its SEC filing, Hong Kong-based fund, IvyRock Asset Management also reported owning nearly $19 Million of Blackrock Bitcoin ETF.

Spot Bitcoin Etfs has recently made a debut on the exchange but so far has attracted less capital as compared to its rivalries.

Is BlackRock The Winner?

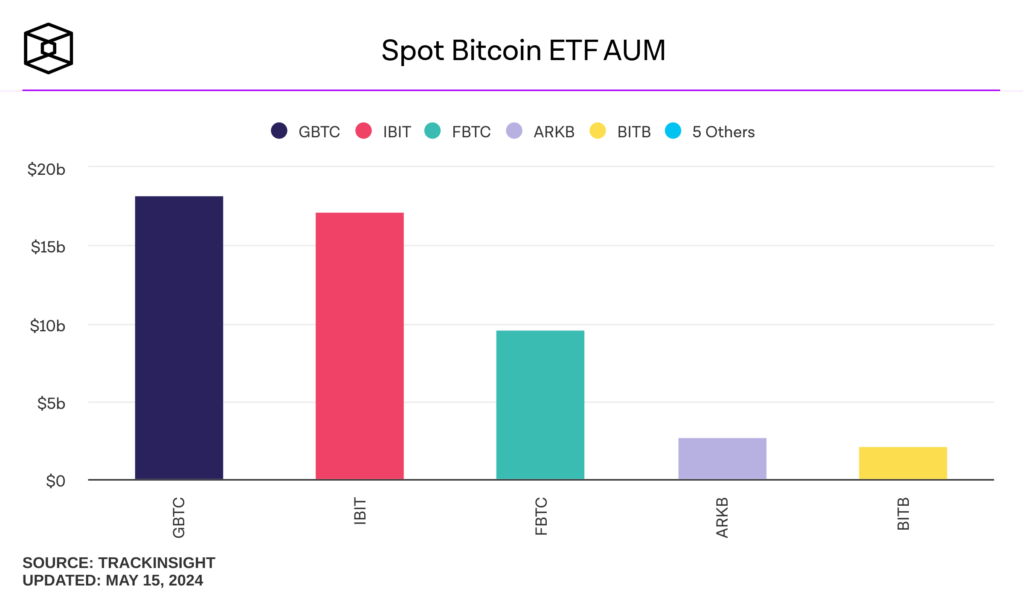

When it comes to assets under management, BlackRock has outperformed the other brand-new spot bitcoin exchange-traded funds that were introduced in January.

The fund managed by Grayscale, which has the greatest AUM at the moment, is a converted fund that began with tens of billions of dollars under management.

That’s it from the experts of ReadingCrytpo for today!

See you again soon!

Disclaimer: This post is intended solely for informational purposes and should not be taken as legal, tax, investment, financial, or any other form of advice. Although all the information provided is true to the best of our knowledge, it is advisable to research well before making any kind of investments or decisions in general. The team of ReadingCrypto bears no responsibility in the event of any adverse outcomes.